Positive Pay Protects Against Check Fraud

What is Positive Pay and How Does it Protect Against Check Fraud?

Positive Pay is a powerful tool used to help prevent fraudulent transactions from posting to business accounts. Both incoming checks and electronic entries (ACH or EFT) can be monitored. If a fraudulent transaction is presented for payment, the customer can reject it right away.

At Mission Bank, there are two areas where Positive Pay can be used to monitor for fraud:

1. Check Clearing

2. Electronic Transaction Clearing (ACH or EFT)

Check Positive Pay

A list of issued checks is uploaded by the customer through the Treasury Management Services (TMS) online banking platform. Check Positive Pay matches the information on checks clearing the account against the list of issued checks uploaded by the customer. The following data is cross-referenced:

-

- Payee

- Check Amount

- Check Number

- Date

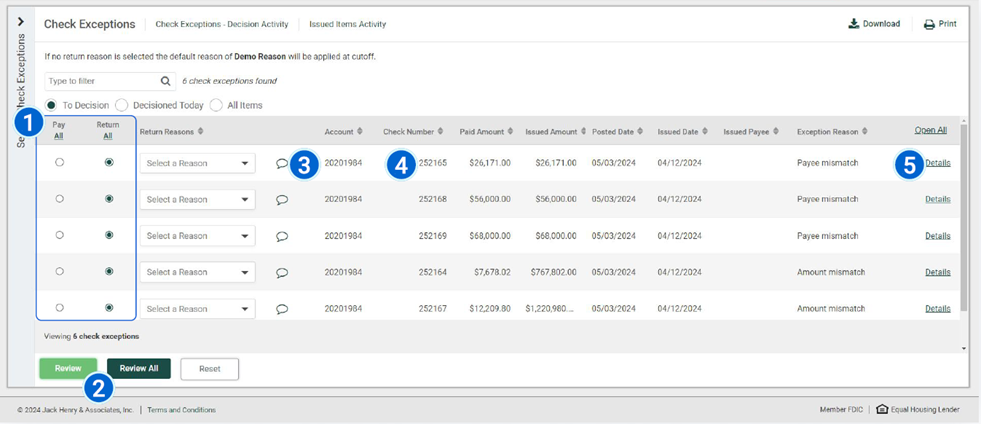

If there is less than a 60% match between the data uploaded, and the data from checks presented for payment, the checks are considered “exceptions”, and an exception report is distributed to the customer daily. Each day the customer must review any incoming exceptions and decide whether the exceptions should be paid or returned. During this time, payment is withheld until the customer decisions the exception item themselves.

ACH Positive Pay

ACH Positive Pay is used to monitor incoming electronic debits to an account. Instead of sending a list of authorized transactions to the bank, a list of authorized originators is established in the TMS online banking platform by the customer. If an ACH entry is presented from an originator that is not on the authorized list, that entry is considered an exception and must be decisioned by the customer.

What are the Benefits of Positive Pay?

- Assists in the quick, efficient, and timely identification of suspicious activity

- Provides efficient and convenient access to decision check exceptions on a desktop or mobile device

- Issues timely notifications of review and cut-off times

- Maintains high visibility of potentially fraudulent items

- Provides access to check images for comparison and additional layers of security

Common Positive Pay Exception Reasons

|

Exception Code |

Exception Reason |

Suggestions to Resolve |

|

AMT |

Amount Mismatch |

Review your ledger for correct amount. If amount has been altered, item should be rejected. |

|

DUP |

Duplicate Item |

Review your ledger and account history for possible duplicate. If item has already cleared your account once, the duplicate should be rejected. |

|

NIS |

Paid Item Without Issue |

Check data not uploaded; review your ledger to ensure that this item was in fact issued. If not, item should be rejected. |

|

PYE |

Payee Mismatch |

Review your ledger for correct payee. If payee has been altered, item should be rejected. |

|

STP |

Stop Payment |

Review stop payment history. If true stop pay match, item should be rejected. |